Since the publication of Bitcoin’s white paper 10 years ago, an entire ecosystem of entrepreneurs, companies, and capital have mobilized around crypto to create a new asset class. As the emerging asset class enters its teenage years, suites of products and services are vying to become pillars in the high-potential crypto ecosystem.

Crypto’s market map continues to grow in both its complexity and in its structure. This post seeks to present a framework of the burgeoning crypto industry, with select examples in their respective segments. It is not exhaustive.

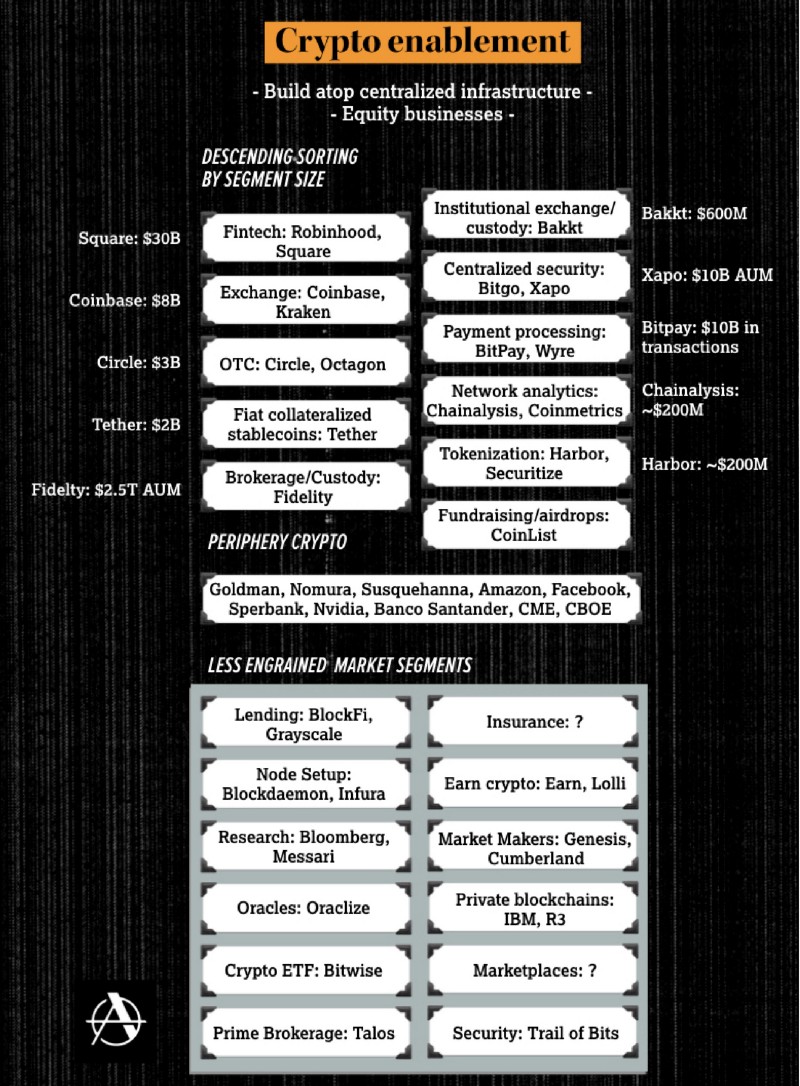

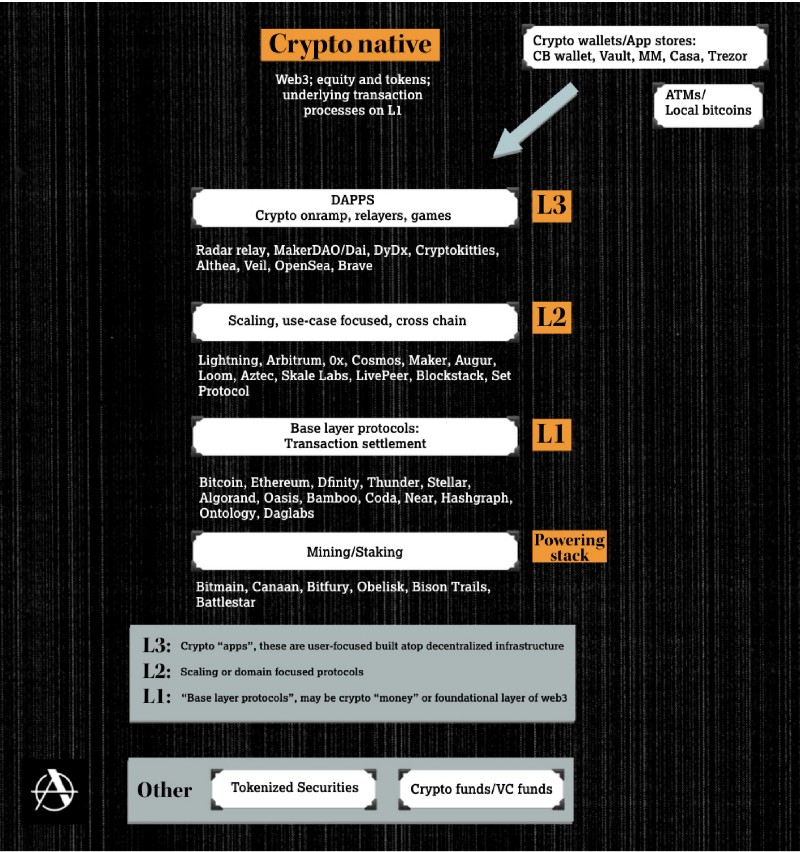

2019 Crypto Market Map

The framework presented above separates the current crypto ecosystem into two overarching categories: crypto-enablement and crypto-native. As the crypto ecosystem continues to mature and professionalize, I expect both developments from crypto-enablement and crypto-native to begin to overlap and complement each other.

The crypto-enablement category consists of companies that are building atop centralized infrastructure. On the institutional side, companies like Fidelity and Square (at $2.5T AUM and $30B market cap respectively) are positioning themselves to be significant players in the crypto ecosystem in the long run. These large institutions, alongside centralized tech startups like Bakkt and Xapo, are offering a variety of crypto-related services such as digital asset exchanges, brokerage, and custody. In recent years, exchanges have been the early winners, largely driven by retail interest in digital assets.

Retail focused crypto exchanges, such as Coinbase and Binance have been early winners within crypto-enablement, as buying volumes hit unprecedented highs in 2017 and early 2018. Ultimately, companies that are building with the crypto enablement category will act as the funnel in educating and offering access to potentially billions of users. I expect less engrained market segments such as crypto lending (BlockFi) and crypto ETFs (subject to regulatory approval), to ramp attractively in 2019.

The crypto-native category is comprised of the actively forming crypto stack and its ancillary pieces: Layer 1 (L1), Layer 2 (L2), Layer 3 (L3), miners, stakers, and crypto-native accessories.

L1 or base layer protocols cover a wide range within the crypto-native stack, varying by account-based or UTXO, consensus mechanisms, flexibility, amongst other criteria. There are more than 60 smart contracting L1 protocols, as of September; ultimately I believe there will be no more than a dozen L1 protocols, but I’ll save that for another post.

L2 are protocols built atop L1, from privacy-focused, to domain-focused, to scalability-focused; these protocols allow dapps to scale to billions of users.Additionally, L2 may offer increased liquidity amongst dapps, effectively making on-chain activity higher in the stack more secure.

L3 — (d)apps are loosely defined given their interconnectivity to lower layers, especially Layer 2. There are interfaces built on top of an existing protocol (Veil:Augur, Expo:DyDX), and applications leveraging their own unique of smart contracts (DyDx). As L1 infrastructure increases transaction throughput and crypto education increases, I expect to see a wave of decentralized applications. Today, dapps often feel clunky for the average user, nowhere near the mobile app experience we’ve grown accustomed to. CryptoKitties, Radar Relay, Expo and others have made strides in making the user experience better —2019 will be an inflection point for crypto native adoption.

Offerings within the mining/staking segment (responsible for block production and transaction validation) will be fascinating to watch as Ethereum inches towards Proof of Stake, and highly anticipate protocols such as Dfinity, Algorand and Coda launch in the coming months. Bitmain and Bitfury will continue to be dominant in powering PoW protocols, where PoS infrastructure is just forming with Bison Trails and Staked as early contenders.

Crypto-native accessories — these may be features, standalone companies, or extensions of companies across the market map. Ultimately, they complement the crypto-native stack. I’ve accounted for 15 specific segments, although could easily add another dozen.

Crypto-native onramps — wallets, app stores, and crypto ATMs allow the masses to participate directly in the crypto-native stack, without the added step of Coinbase signup, digital asset purchase, delay, and transfer to X dapp.

Conclusion

When I made my first venture investment in crypto in 2015 (Chainalysis), the total market cap was below $5B. As of this writing, that number is roughly $100B with an additional tens of billions in enterprise value from crypto-enablement companies like Coinbase and Binance.

Startups, institutions, large enterprises, and users around the world are driving crypto to form an entirely new asset class. As on-chain transactions increase, crypto-enablement takes on a symbiotic role in delivering crypto to billions of users.

-Ash

I’m an early stage investor at Accomplice, focused on crypto networks and crypto enabled companies. Please don’t hesitate to reach me on Twitter with feedback, comments, or general thoughts.

Special thanks to Jeff Fagnan, Sarah Downey, Ivan Bogatyy, Katherine Wu and James Prestwich for reviewing versions of this post.

Footnotes

**the periphery crypto segment is primarily massive enterprises dabbling in crypto, but remain on the sidelines compared to all-in groups like Fidelity and Square.

**crypto funds/vc funds, structured as hedge funds or long-term venture funds are backing entrepreneurs within crypto-enablement and crypto-native.

**tokenized securities and security tokens as extensions of traditional equity, primarily enabled by Reg-A+ and Reg-D offerings.

**I’m excited to see how crypto will be introduced into existing marketplaces- as payment, escaping expensive fees, or earning crypto for contributing.